HEX Crypto: How to Mine HEX

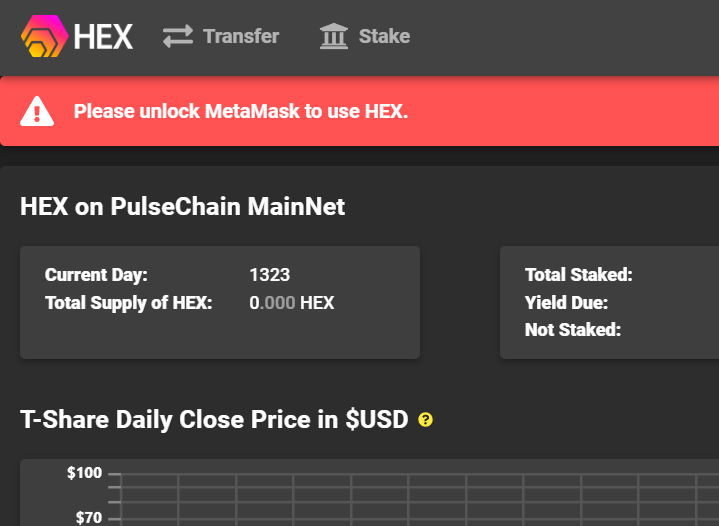

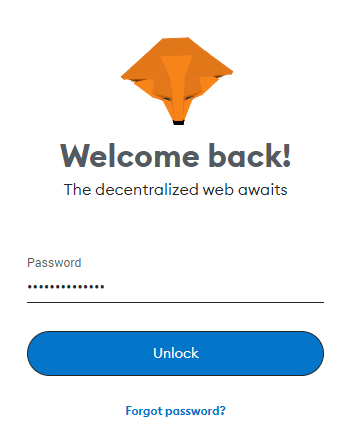

Unlock Metamask

Click fox icon

Enter password & click Unlock

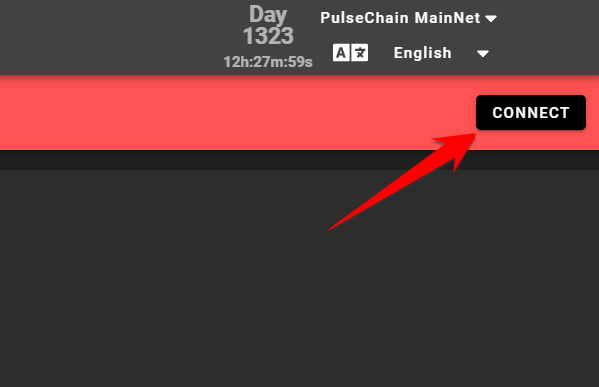

Click Connect

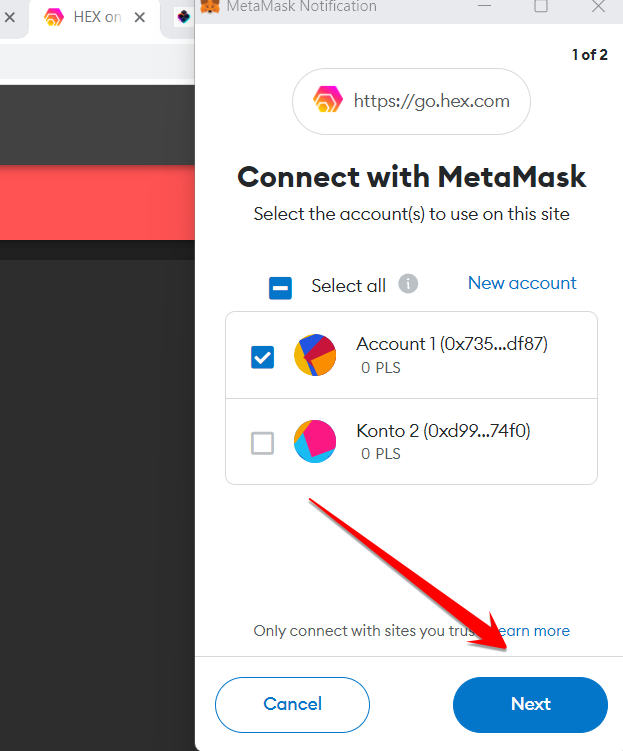

Click Next

Click Connect

1) When you start a Stake/Miner you have less than 24 hours before it turns Active. All you need to do is wait until 7pm EST or 0h00 UTC that same day in order for all the stakes to officially start So for any reason if you want to end the miner do it before the 24 hours. If you end a miner after that time you will loose most of your initial HEX. Make sure you are comfortable waiting 100% of the time you set. If you set a miner for 15 years, make sure you can afford to wait.

2) Never End a miner before 90 days have passed. If you have a miner that is shorter than 90 days then wait until it is finished before you click the End Stake button.

3) Make sure you do not end a miner before 50% of the time has passed. If you wait til 50% then you will get back your initial HEX but none of the yield generated. This is all calculated by the smart contract when you end the miner.

If you for example end the miner after 40% of the time passed you will get back less HEX than you started with. If you wait 60% of the time you will get back all your HEX and some of the yield generated. The longer you wait and the closer to 100% you wait, the more yield you get. If you wait until the miner is 100% finished then you will get back your initial HEX plus all the yield generated.

4) AFter the miner is finished you have 14 days to End the Stake before any penalties. After the 14 days you will loose 1% every week until you End the miner. This is to prevent diluting the T-share pool and make people do what they say they will do.

Advanced users: You have an option to use the Good accounting function when a miner is finished. This will not end the miner but it takes the T-shares out of the pool and you will not incur any penalties. If you choose to good account the miner you pay a fee when you take the shares out of the pool and and a fee when you end the miner.

If you did not understand the good accounting function do not worry. This is an advanced topic, just make sure you understand that you have 14 days to end the stake by clicking the black end stake button. If you do that you will not incur any penalties!

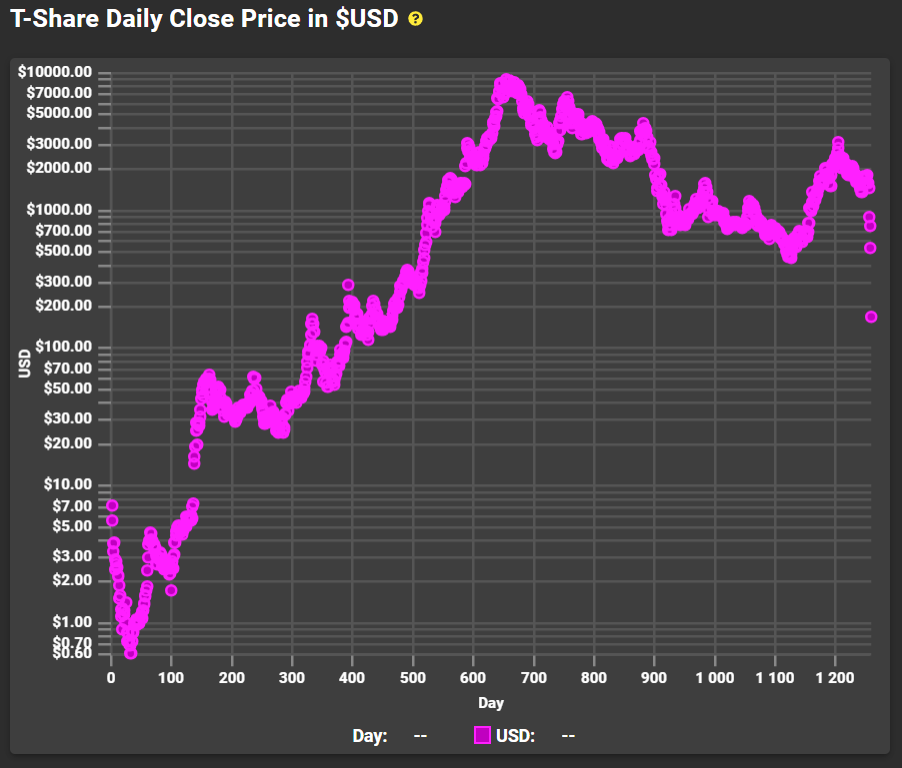

1) T-Share Daily Close Price in $USD shows how much it cost to aquire 1 T-Share. If you hoover the mouse over the last dot it shows that it cost $170 to aquire 1 T-Share on July 21st 2023. We can see that on day 33 it only cost $0.61 to aquire 1 T-Share. The share price fluctuates up and down but over time it goes up.

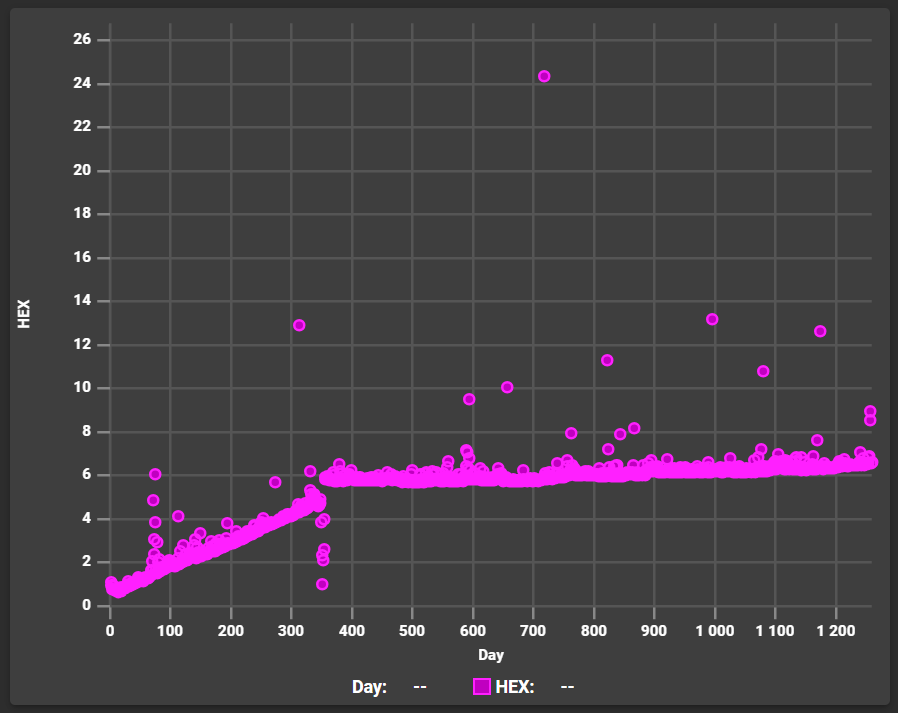

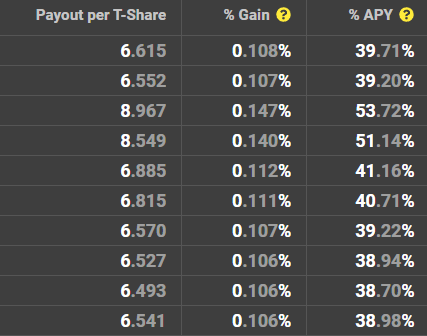

2) Daily HEX Payout per T-Share shows how many HEX you get in daily yield based on how many T-Shares you have. It slowly increases and is averaging above 6 HEX per T-Share in yield.

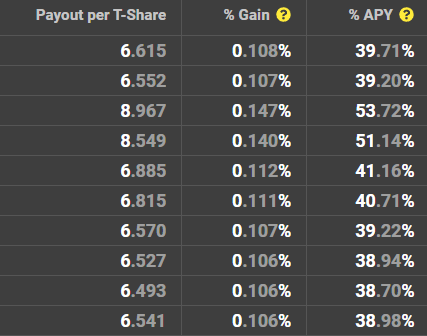

3) Daily Data shows how much the payout is. For example on day 1262 the Payout per T-Share was 6.615 Hex per T-share. So if you had 1 T-Share this day you would get 6.615 HEX in yield. The payout slowly increases with time as it get more expensive to aquire T-shares. Right now the payout is on average 6 HEX per T-Share. The T-Shares are deflationary and cost more as time goes by. The yield is also dynamic and is set by the number of miners. If the number of miners decrease the yield goes up, if the number of miners increase the yield goes down. The average stake length for the entire HEX eco system (july 2023) is 123000 active miners that have $1.3B locked up for an average of 6.98 years. To get the high APY of over 38% you need to lock up on average 7 years. The longer you wait the more risk you take and the more you get paid in yield.

Cost to aquire 1 T-Share

Payout per T-Share

Payout data

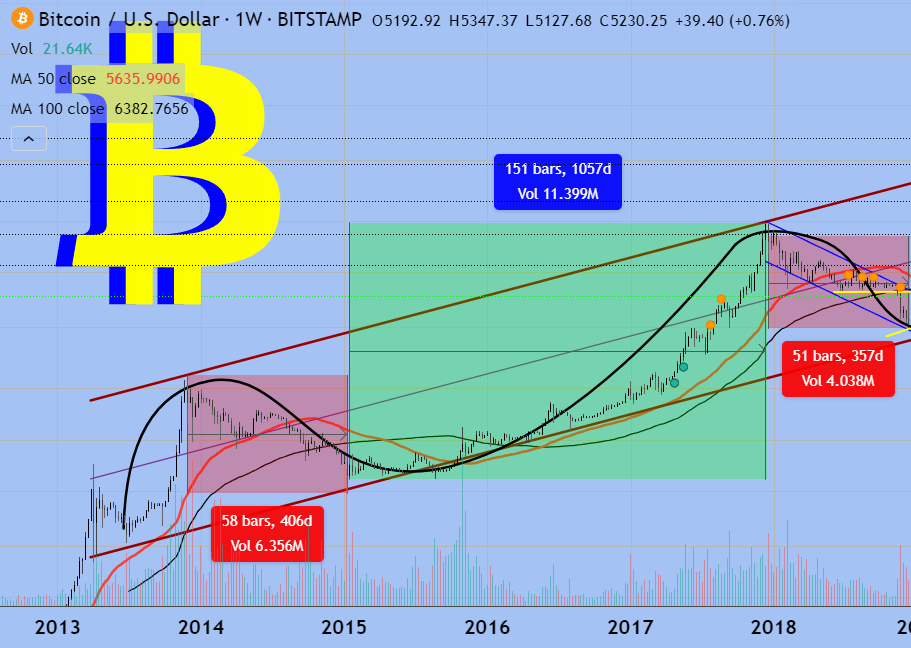

It started January 3rd 2009 with a payout of 50 BTC per block mined. The first halvening was November 28th 2012 where the reward was 25 BTC per block mined. Then May 11th 2020 it got cut to 6.25 BTC. The next halvening is around March 2024 where BTC miners get 3.125 BTC. Then in 2028 they get 1.56 BTC.

This continues until there is no more supply to be mined. Price has in the past moved up in anticipation of the halvening, followed by a sell off after the fact. And then there has been a blow off top a year after that. So if the history repeats we might get a blow off top in 2025/2026. The volatility has gone down in every cycle so the returns are deminishing. HEX has outperformed BTC as many tokens do, but they often follow Bitcoin as BTC is the biggest token and has the most liquidity.

According to Heart`s law tokens like Bitcoin and Ethereum move up and down together because they are bonded by the liquidity. The question is will history repeat? If it does then the next years will be filled with sideways and upside momentum!

The 4 Year Bitcoin Cycle

Over 1 Year of Downside

Histrically 3 Years of Upside. Price Go UP!

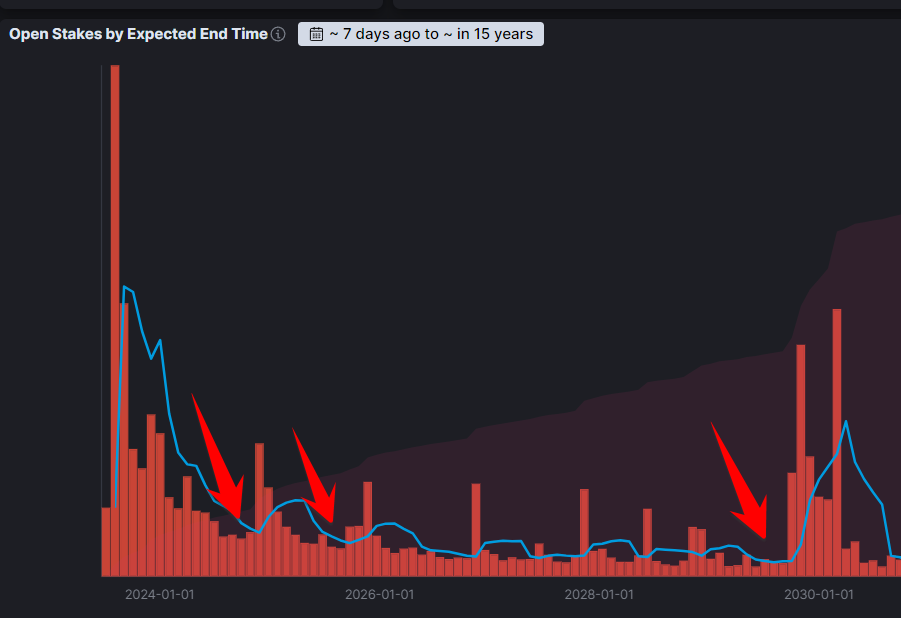

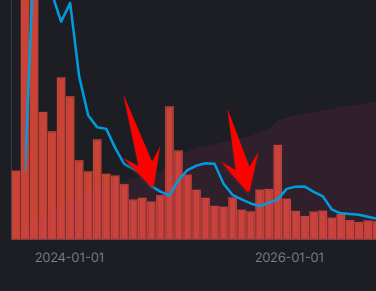

1) Here is the miner supply for the next 7 years. When you make a new miner it is a good idea to put the length of the miner before any big spikes in the chart. This is because when there are big spikes, this means that there is more HEX coming to market and that potentialy can sell the price down more than in periods with less supply coming to market.

2) Around august 2025 and august 2026 looks to be periods where there is less supply coming to market.

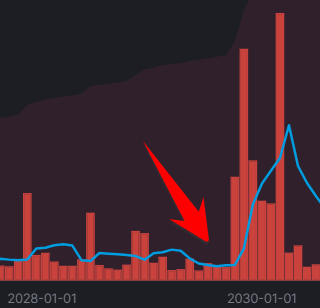

3) Same for august 2029 looks to be before a big spike in supply of HEX coming to market. These years also looks good if we look at the 4 year Bitcoin cycle that has been present since 2009 when Bitcoin launched.

Future Cycle Tops? (year): 2025/2026, 2029/2030, 3033/3034, 3037/3038, 2041/2042, 2045/2046, 2049/2050. This is pure speculation and noone knows what the future holds. Do not invest any money that you can`t afford to loose.

7 Years of HEX Future Supply

Mine August 2025 & August 2026

Mine August 2029

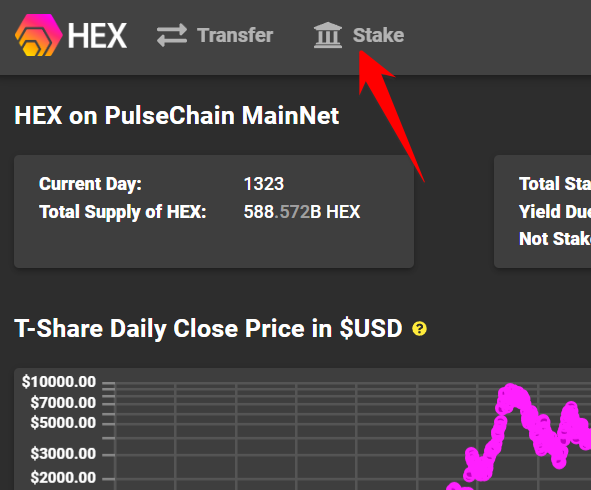

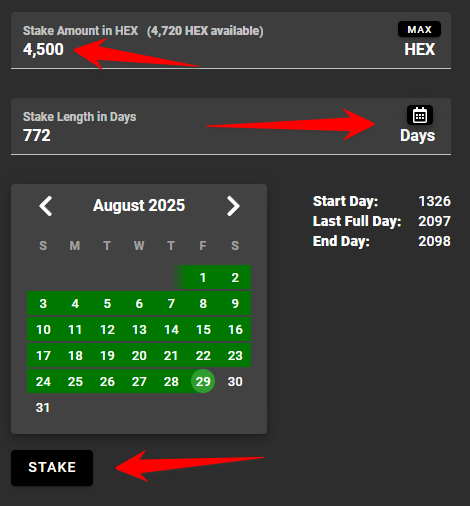

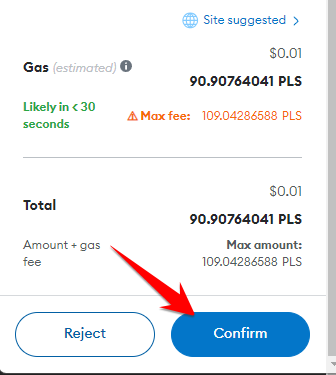

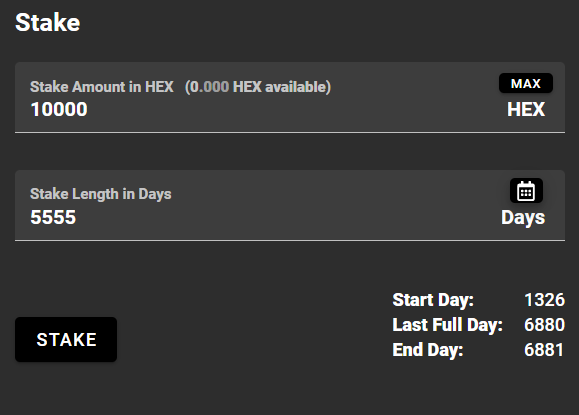

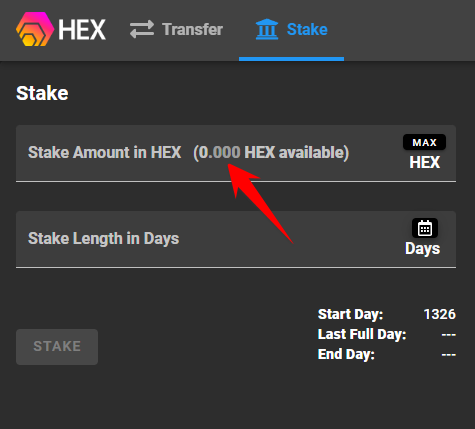

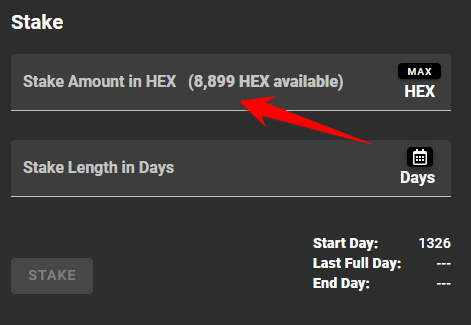

1) Click on the Stake tab on top of the webpage. 2) The important part to notice is you can lock up your HEX to gain yield, but you don`t have to. If you don`t lock any you don`t get any yield. You can choose to lock between 1 and 5555 days. The longer you lock the more you get. The more you lock the more you get. But longer always pays better. Insert the number of HEX you would like to Mine. Insert number of days you would like to mine or click on the calendar to set the end date. Then click Stake. 3) When the Metamask pop up, review the fees and click Confirm.

Click Stake tab

Insert amount of HEX, Insert number of days & click Stake

Click Confirm

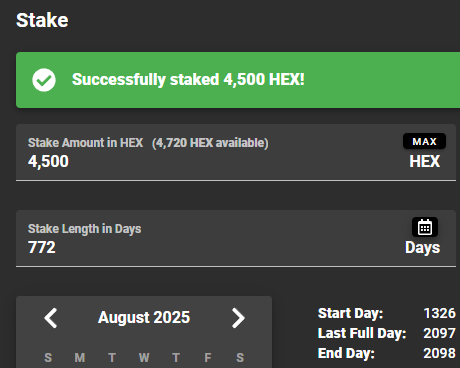

1) You will get a message that tells you that the miner is successfully started. You have 24 hours before the miner starts, if you end it before it starts you will get back your principal. Do not end the miner after 24 hours! Do not end it until it is finished without reading the rules above.

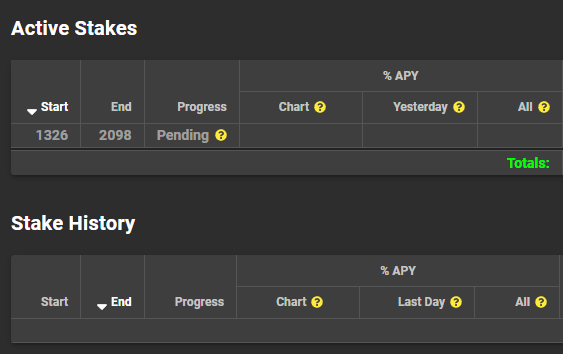

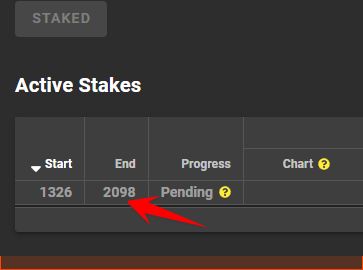

2) If you scroll down on the page you will see details about your Active Miner. The start date is obviously the date you started the miner. The end date is the day will end the miner. You can hoover your mouse over the number to see the exact date it is finished. When a miner is finished it will move down to the Stake history tab below the active Stakes tab.

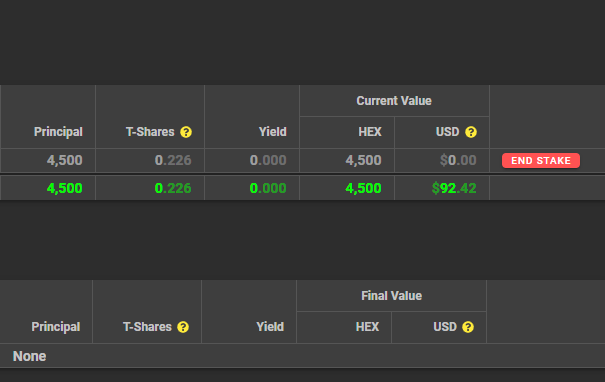

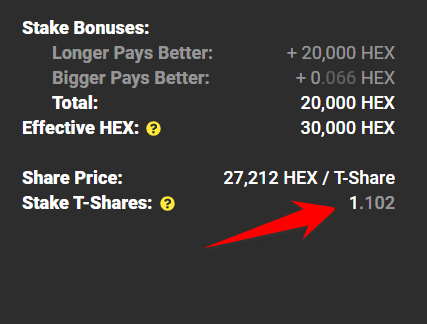

3) Principal is the number of HEX you mined. T-shares show how many HEX you get per day per T-share. In this example the payout per T-share is 6.615 HEX and we have 0.226 T-shares, so we get 1.5 HEX in yield. The more T-shares you got, the more yield the smart contract generates. You can see there is a yield tab that shows your accumulated yield over time, it start at 0. Lastly you can see the total amount of HEX you have included yield and the current $ value of your miner. You can make as many miners as you like.

Miner Started Successfully!

Active Miners

Total HEX & Earnings

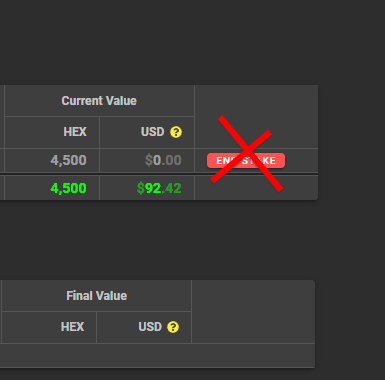

1) Do not end it until it is finished. If you end it before the time is up you need to know the consequences. See rules above.

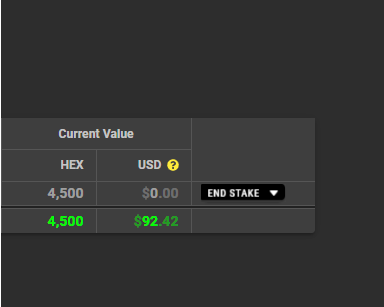

2) When the miner is finnished and 100% of the time has passed, the button will turn black. If you click it you will get two options. End stake or Good accounting. Ending a miner is a taxable event. If you choose Good accounting your HEX will not be minted but the T-shares will be taken out of the staked HEX supply and you will not incure any penalties and you can then End the miner whenever you would like to without risking your principal and you will get all your yield.

3) If you hoover your mouse over the date you can see the exact date when the miner was started and the date it will end.

Do NOT Click End Stake Before It is 100% Finished

When 100% Finished Button Turn Black

Hoover Over to See Exact Date

To make this example easier we assume that the payout per day is 6 HEX (it will in increase over time), so if you get 6 HEX for 5555 days the yield will be 33330 HEX. If you owned 10 T-shares you would get 66.15 HEX in yield that day and 367463 HEX after 5555 days etc. Nobody knows what the price will be, but we can speculate that it will be higher than today ($0.010186 on Ethereum & $0.021396 on Pulsechain).

The 4 Year Bitcoin Cycle

Over 1 Year of Downside

Payout to Mine HEX for 5555 Days (max)

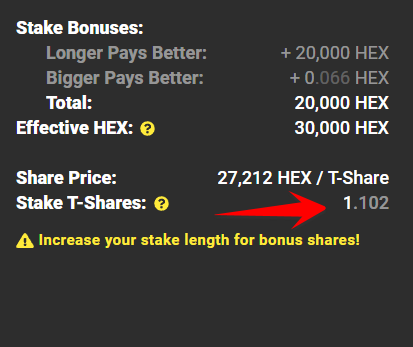

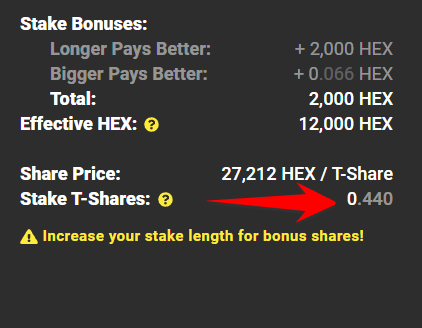

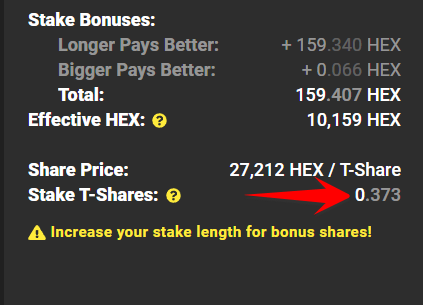

1) For 10 years you get the same amount of T-shares as for a 15 year miner (5555 days) and 20000 HEX in bonus. 2) For 1 year you get 0.44 T-Shares and 2000 HEX in bonus. You can see that you get less T-Shares if your miner length is shorter. 3) For a 1 month miner you get 0.373 T-Shares and only 159 HEX in bonus.

Payout to Mine HEX for 10 Years

Payout to Mine HEX for 1 Year

Payout to Mine HEX for 1 Month

10000 / 0,020081 = 497983 HEX ($10000)

497983 / 30 = 16600 HEX per day

How many T-shares to make 16600 HEX a day? If we assume the average payout per T-share is 6 HEX per T-share

16600 / 6 = 2766 T-Shares

What is the cost of 2766 T-shares?

1 T-share cost 27212 HEX

2766 * 27212 = 75,3M HEX

That is a lot! You would have to pay $1,5M to get $10000 in monthly CF..

But what if the price goes up? $0,10? You would need 100000 HEX in yield or 3333 HEX per day

3333 / 6 = 555,5 T-Shares

555,5 * 27212 = 15,12M HEX

15,12 * 0,1 = $1,5M

$1 HEX? 10000 HEX and 333 HEX a day

333 / 6 = 55,5 T-Shares

55,5 * 27212 = 1,51M HEX

1,51 * 1 = $1,5M

The number of HEX you need to get T-Shares increases with time so it will get even more expensive in the future. It is a good plan to aquire as many T-Shares as possible and mine for as long as possible to capture the value of the T-Shares when the price of HEX rises.

If you want to make $1000 in monthly CF then you would need $150k at current share rate and HEX price. If you want to make $100 in monthly CF then you would need $15k at current share rate and HEX price.

So if you can get 1,5M HEX today for $30122 (0.020081 *1500000). If HEX is $1 then you would need 1,5M HEX to make $10000 in monthly CF (assuming todays share rate).

This is speculation so take it with a grain of salt, nobody knows what the price will do but historically the price goes up and to the right in a bull market.

Would you rather aquire T-shares and HEX now to potentialy earn $10000 in monthly CF + have the ability to sell your HEX for $1.5M in the future or would you sell the bottom for $30k now? This is an extreme example but the reason for showing this is to focus on the mindset and the potential for a longer time horizon.

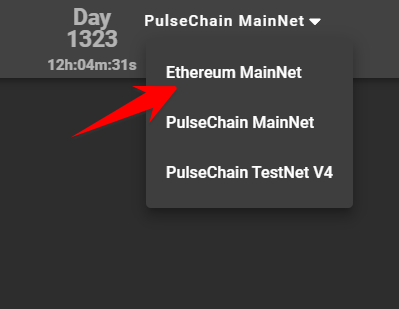

HEX On TWo Chains (Ethereum & Pulsechain):

Mine HEX Pulsechain Cost: $0.01 vs. $12.37 on Ethereum

Click Pulsechain Mainet to Change Chain

0 HEX on Pulsechain

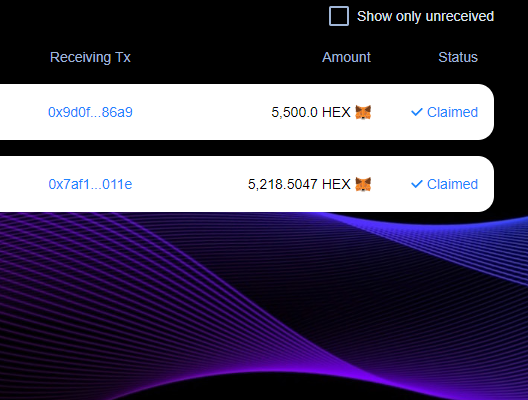

Bridged Over HEX From Ethereum

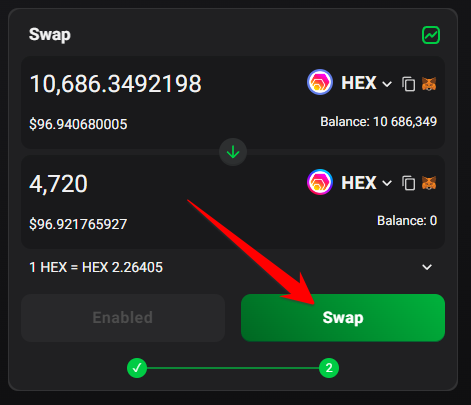

Swap eHEX to HEX

HEX From Pulsechain Balance